DIVIDEND

Projected for Investment Shares in 2025/2026.

Dividends are paid within 30 days of the anniversary date of the respective Series. Check your statement for the specific details on your particular Series.

Proven Returns

A product with a history of market-leading dividends means more money back in your pocket.

Hands-on Support

Providing better services and programs for our communities to enjoy.

Financial Tools

Industry-leading products built to help all our members reach their financial goals.

Start enjoying premium returns today with WFCU Investment Shares!

Learn more about WFCU Investment Shares and see if they are a right fit for your financial goals.

Prefer to skip the form? Contact a branch near you or email info@wfcu.ca.

How do Investment Shares work?

Investment Shares are a straightforward investment option. Each Investment Share costs $1 with a minimum purchase of 500 Investment Shares ($500) to get started. This can be funded from your account, including your Tax-Free Savings Account (TFSA), Registered Retirement Savings Plan (RRSP), or Registered Retirement Income Fund (RRIF).

What Are the Benefits?

Premium Returns

If you’re looking to diversify your portfolio while minimizing risks, our Investment Share series is the perfect addition to your holdings.

Stronger Together

When you invest directly with us, it helps strengthen WFCU Credit Union and its divisions across Ontario, benefitting all members through innovative banking products and services.

Local Impact

Investment Shares help support our mission to make the 20 communities we serve the best places to live and work.

Comparison

Investment Shares vs GICs vs Publicly Traded Shares

| WFCU Investment Shares | GIC | Publicly Traded Shares | |

|---|---|---|---|

| Company Ownership | Yes | No | Yes |

| Purpose | Grow the Credit Union while providing a return members who hold investment | Provide a return to deposit holders | Grow the company while providing a return to shareholders |

| Typical Horizon | Long-term | Short to medium-term | Short to long-term |

| Risk level | Lower | Lower | Higher |

| Registered Product Eligibility | Yes (RRSP, TFSA, RRIF) | Yes (RRSP, TFSA, RRIF, FHSA, RESP, RDSP) | No |

| Returns | Dividends based on fiscal performance | Fixed percentage rate | Varies; value fluctuates based on market demand, potential for dividends based on fiscal performance for certain shares |

| FSRA Insured | No | Yes | No |

| Fees to Purchase | No | No | Can be a percentage fee or flat fee. Depends on platform used to purchase |

| Redeem/Sell | Find an eligible buyer through the credit union*, no fees apply | Automatically at term maturity date | Sold on the open market |

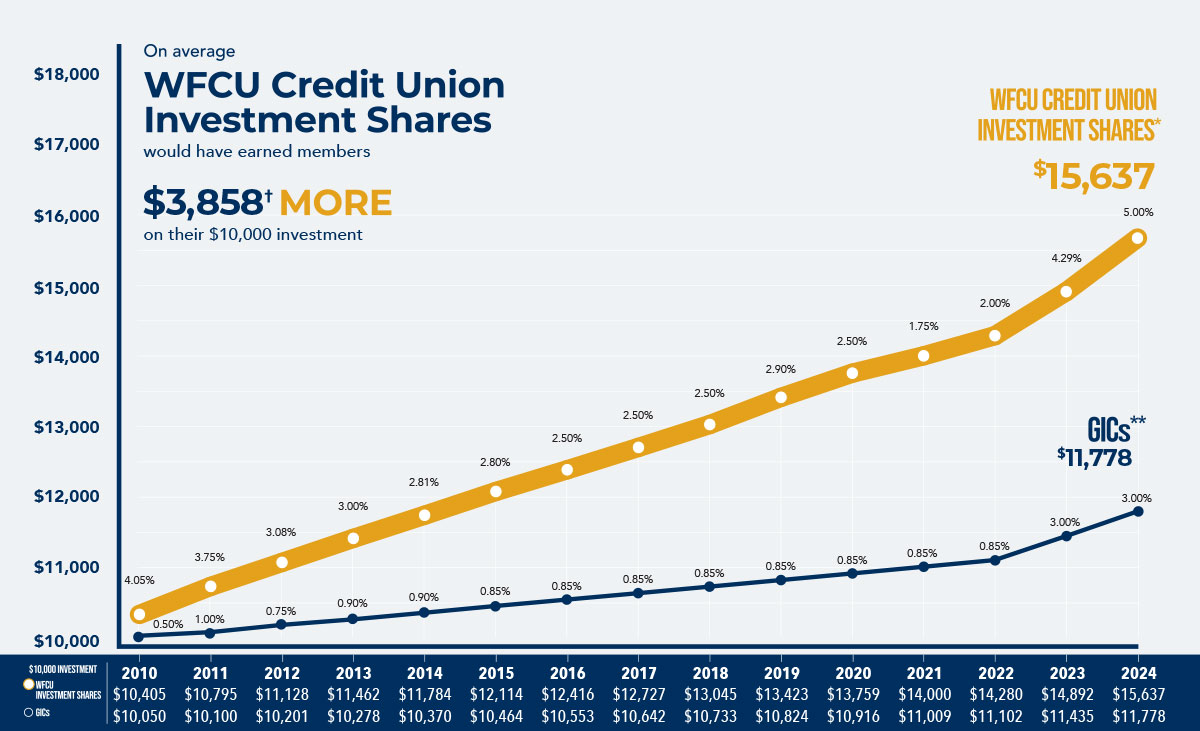

Historical WFCU Investment Shares Return (Series 1)

in Comparison to GICs Return

* Rate displayed is for WFCU Credit Union Series 1 Class A Investment Shares. Rate is reflective of the actual dividend paid. **Rate displayed is the actual 1-year WFCU GIC rate as at April 1 of each respective year. †Amounts reflected are a comparison of WFCU Credit Union Series 1 Class A Investment Shares and a WFCU Credit Union 1-year GIC held since 2010 and includes annual compounding.