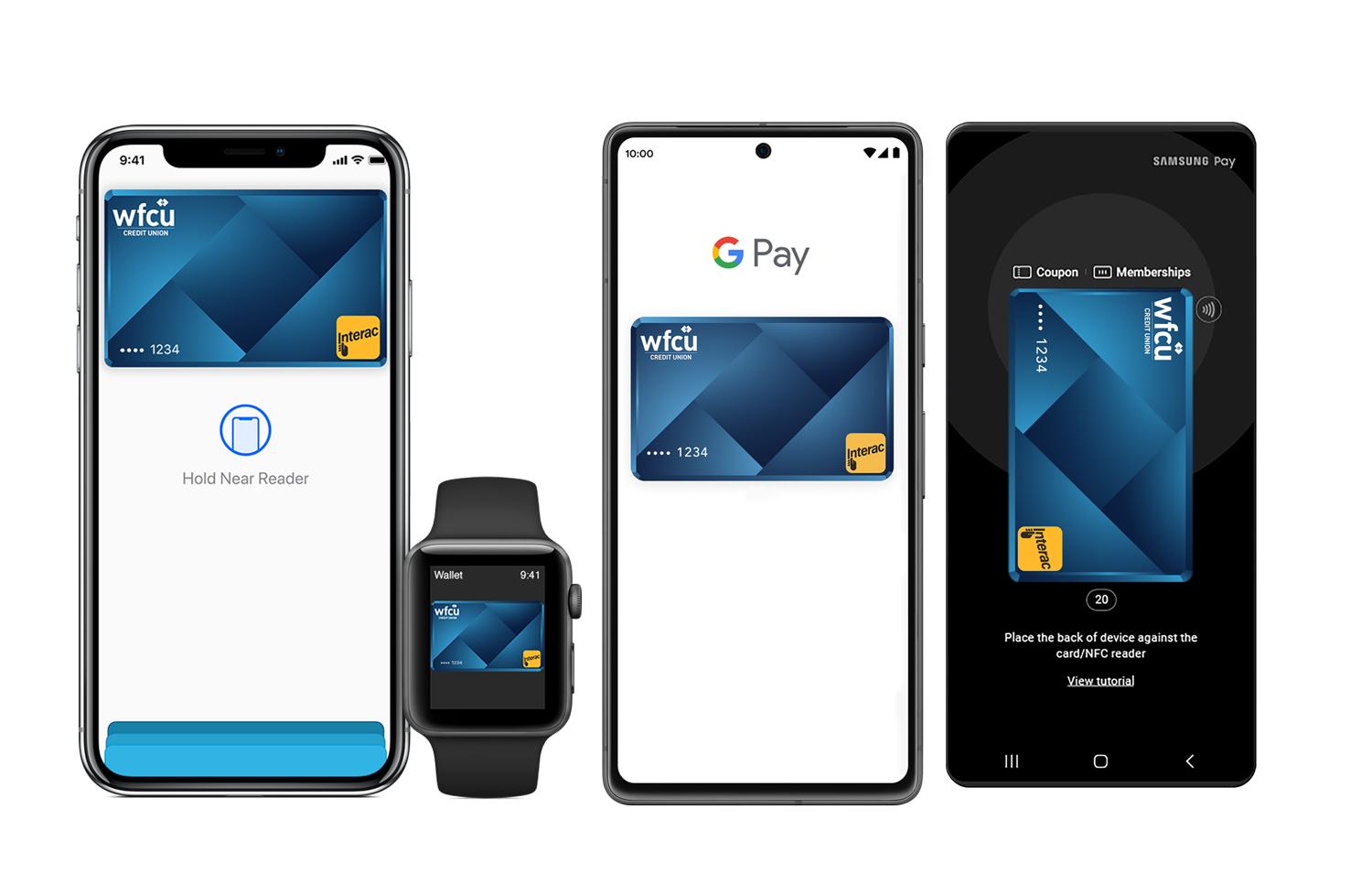

WFCU Credit Union and its divisions make digital banking even easier with the integration of mobile wallet technology. Whether you have an iPhone, Samsung, or Google device, load your Debit Mastercard® onto your mobile wallet, and payment is just a tap away.

Connect your Debit Mastercard to your iPhone or Apple Watch by clicking the plus sign below and following the step-by-step instructions.

How to add your Debit Mastercard to Apple Pay:

On your iPhone

- Open the Wallet app.

- Tap the (+) sign in the upper right corner.

- Follow the on-screen instructions to add your Debit Mastercard.

On your Apple Watch

- Open the Apple Watch app on your iPhone.

- Go to the My Watch tab. If you have multiple watches, choose one.

- Tap Wallet & Apple Pay and select Add Debit Card.

- Follow the onscreen instructions to add your Debit Mastercard.

Paying with Apple Pay

On an iPhone 8 or earlier with Touch ID:

- Rest your finger or thumb on the home button and hold the top of your iPhone within a few centimetres of the contactless reader.

- You will see Done and a checkmark on the display letting you know your payment was approved. If vibration and sounds are enabled, you will feel a subtle vibration and hear a beep.

On an iPhone X:

- Double-click the side button.

- Glance at iPhone X to authenticate with Face IDor enter your passcode.

- Hold the top of iPhone X within a few centimeters of the contactless reader until you see Done and a checkmark on the display.

On an Apple Watch:

- Double-click the side button and hold the display of your Apple Watch within a few centimetres of the contactless reader.

- Wait until you feel a gentle tap.

- You will see Done and a checkmark on the display letting you know your payment was approved.

Where to Use Apple Pay

Using your Debit Mastercard on Apple Pay works wherever Interac® Flash is accepted. Just look for the Interac logo or contactless symbol at the checkout. Some stores will also display the Apple Pay logo.

For Android users, Google Pay makes contactless payment simple and convenient. Connect your Debit Mastercard today by following the quick and easy steps below.

How to set up Debit Mastercard with Google Pay:

On your smartphone

- Download Google Wallet from the Google Play Store.

- Open the Google Wallet app.

- Tap the (+) sign.

- Follow the on-screen instructions to add your Debit Mastercard.

On your wearable

- Open Google Wallet on the watch.

- Tap (+) to Add Card and choose your Debit Mastercard.

- Follow the on-screen prompts to complete setup.

Paying with Google Pay

On your smartphone:

- Unlock your phone.

- Hold your phone over the terminal until you see a blue check mark on the screen.

On your wearable:

- On your watch, open the Google Wallet app.

- Hold your watch over the contactless payment terminal until you hear a sound or feel vibration from your watch.

Where to Use Google Pay

Using your Debit Mastercard on Google Pay works wherever Interac® Flash is accepted. Just look for the Interac logo or contactless symbol at the checkout. Some stores will also display the Google Pay logo.

Add your Debit Mastercard to the mobile wallet on your Samsung device by clicking on the plus sign below and following the step-by-step instructions.

How to add your Debit Mastercard to Samsung Pay:

On your mobile device

- Open your Samsung Wallet.

- Tap the (+) sign in the upper right corner.

- Follow the on-screen instructions to add your Debit Mastercard.

Paying with Samsung Pay

On your mobile device:

- Open your Samsung Wallet.

- Select your Debit Mastercard.

- Authenticate your card with PIN, fingerprint, or iris scan.

- Hold your phone to the payment terminal. A subtle vibration and beep will confirm your payment and the screen will show a checkmark with a “Payment completed” message. The payment terminal will also let you know when the payment is approved.

Where to Use Samsung Pay

Using your Debit Mastercard on Samsung Pay works wherever Interac® Flash is accepted. Just look for the Interac logo or contactless symbol at the checkout. Some stores will also display the Samsung Pay logo.

Mobile Wallet Terms of Use

IntroductionThese Terms of Use (“Terms”) govern your use of any eligible Credit Union debit card (“Card”) when you add or keep your Card in a mobile wallet (“Wallet”) for use on any eligible device (“Device”) that supports the use of the Wallet.

Please read these Terms carefully. If you add or activate your Card for use in a Wallet, it means that you accept and agree to these Terms. In these Terms, “you” and “your” means each Credit Union member who has been issued a Credit Union Card. “We”, “us”, and “our” mean Credit Union.

Other Documents and Agreements

These Terms are in addition to, and supplement, all other agreements between Credit Union and Member regarding Credit Union’s products and services. If there is any conflict or inconsistency between these Terms and the other agreements, then these Terms will take priority and govern with respect to the Wallet service.

You understand that your use of the Wallet will also be subject to agreements or terms of use with the relevant Wallet Provider (“Wallet Provider”) and other third parties (such as your wireless carrier and the websites and services of other third parties integrated with the Wallet).

Use of Cards in the Wallet

If you want to add a Card to a Wallet, you must follow the procedures adopted by the Wallet provider, any instructions provided by us, and any further procedures the Wallet provider or we adopt. You understand that we may not add a Card to a Wallet if we cannot verify the Card, if your account is not in good standing, if we suspect that there may be fraud associated with your Card or for any other reason we determine at our sole discretion. The Wallet allows you to make purchases using your Card wherever that Wallet is accepted. Wallets may not be accepted at all places where your Card is accepted.

Removal, Blocking, or Suspension of Card

We may not permit the addition of a Card to a Wallet, or we may remove, suspend or cancel your access to a Wallet at any time, if we cannot verify the Card, if we suspect that there may be fraud associated with the use of the Card, if your account is not in good standing, if applicable laws change, or for any other reason we determine at our sole discretion.

You may suspend, delete or reactivate a Card from a Wallet by following the Wallet Provider’s procedures for suspension, deletion or reactivation. In certain circumstances, your Card may be suspended or removed from the Wallet by the Wallet Provider.

Maximum Dollar Limit

Payment networks, merchants or we may establish transaction limits from time to time in their or our discretion. As a result, you may be unable to use a Wallet to complete a transaction that exceeds these limits.

Applicable Fees

We do not charge you any fees for adding a Card to the Wallet. Please consult your Card agreement for any applicable fees or other charges associated with your Card.

Your mobile service carrier or provider, Wallet Provider or other third parties may charge you service fees in connection with your use of your Device or the Wallet.

Security

You must contact us immediately if your Card is lost or stolen, if your Device is lost or stolen, or if your Card account is compromised. If you get a new Device, you must delete all your Card and other personal information from your prior Device.

You are required to contact us immediately if there are errors or if you suspect fraud with your Card. We will resolve any potential error or fraudulent purchase in accordance with the applicable account agreement.

You agree to protect and keep confidential your Wallet Provider ID and passwords. If you share these credentials with others, they may be able to access a Wallet and make purchases with your Card or obtain your personal information.

Before using a Wallet, you should ensure that only your credentials are registered on your Device as these will then be considered authorized to make transactions related to your Card. If the credentials of another person are used to unlock your Device or make transactions, these transactions will be deemed to be authorized by you.

You are prohibited from using a Wallet on a Device that you know or have reason to believe has had its security or integrity compromised (e.g. where the Device has been “rooted” or had its security mechanisms bypassed).

The Wallet Provider is responsible for the security of information provided to them or stored in the Wallet.

Liability for Loss

You are solely responsible for all account transactions made using your Card processed through a Wallet. You are responsible for the completeness and accuracy of the account information you enter into the Wallet. Only the individual member whose name is associated with the Card should add the Card to a Wallet.

Privacy

You consent to the collection, use and disclosure of your personal information from time to time as provided in our privacy policy, which is available on our website. We may share with or receive from the Wallet Provider such information as may reasonably be necessary to determine your eligibility for, enrollment in and use of a Wallet or its features you may select (for example, your name and details such as Card number and expiry date).

The Wallet Provider may aggregate your information or make it anonymous for the purposes set out in its privacy policy or terms of use. To help protect you and us from error and criminal activities, we and The Wallet Provider may share information reasonably required for such purposes as fraud detection and prevention (for example, informing the Wallet Provider if you notify us of a lost or stolen Device).

Communications

You agree to receive communications from us, including emails to the email address or text message to the mobile number you have provided in connection with your Card account. These communications will relate to your use of your Card(s) in the Wallet. You agree to update your contact information when it changes by contacting us. You may also contact us if you wish to withdraw your consent to receive these communications but doing so may result in your inability to continue to use your Card(s) in the Wallet.

No Warranty and Exclusion of Liability

For the purpose of this Section, “Credit Union” means Credit Union and its agents, contractors, and service providers, and each of their respective subsidiaries. The provisions set out in this section shall survive termination of these Terms.

The Wallet service is provided by the Wallet Provider, and Credit Union is not responsible for its use or function. You acknowledge and agree that Credit Union makes no representations, warranties or conditions relating to the Wallet of any kind, and in particular, Credit Union does not warrant: (a) the operability or functionality of the Wallet or that the Wallet will be available to complete a transaction; (b) that any particular merchant will be a participating merchant at which payments with the Wallet are available; (c) that the Wallet will meet your requirements or that the operation of the Wallet will be uninterrupted or error-free; and (d) the availability or operability of the wireless networks of any Device.

Credit Union will have no liability whatever in relation to the Wallet, including without limitation in relation to the sale, distribution or use thereof, or the performance or non-performance of the Wallet, or any loss, injury or inconvenience you suffer. You may want to consider keeping your physical Card with you to use in the event you cannot make Wallet transactions.

Changes to the Terms of Use

We may change these Terms, or the agreements associated with the use of your Card with the Wallet. You agree to any changes to these Terms or agreement(s) associated with the use of your Card or account by your continued use of your Card with the Wallet. If you do not accept the revised Terms or agreement(s), you must delete your Card from the Wallet.

Contacting Us

You may contact us about anything concerning your Card or these Terms by calling the phone number found on our website.

If you have any questions or complaints about the Wallet, or disputes with the Wallet Provider, you should contact the Wallet provider.

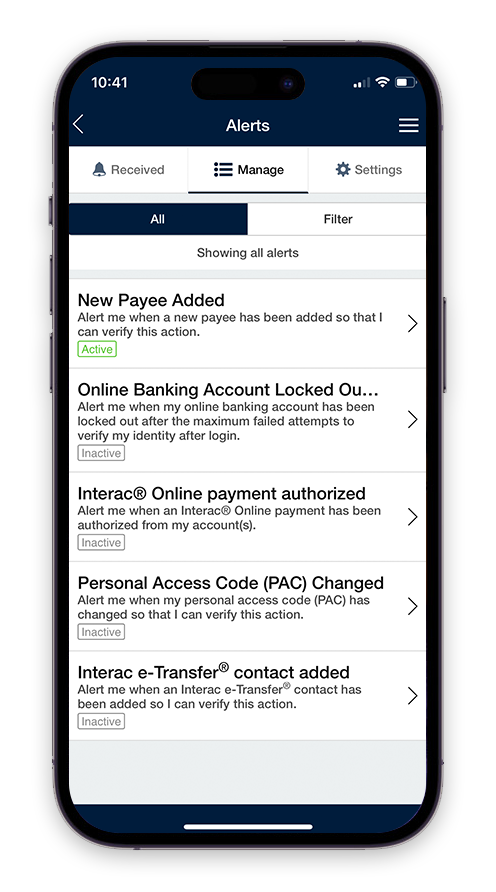

Member Alerts

As an added online security feature, members can sign up for Alerts through Online Banking. These Alerts will be sent to you through email or text message on your mobile device.

The following Alerts are available:

New Payee

A New Payee has been added to your account

New Recipient

A New Interac e-Transfer® Recipient has been added to your account

Security

Your Personal Access Code (PAC) has changed

Locked

Online Banking Account Locked out – Incorrect response to Security Question

You can activate all Alerts or select only the Alerts that are important to you. When activated, you will receive an email or text message to notify you when any of these actions have occurred on your account.

If you have questions or would like assistance to set up Alerts in Online Banking, please contact our Member Contact Centre at 1-866-500-9328 or visit your local retail branch.

Need more information?

Interac e-Transfer® Service

A great alternative to cheques and cash, Interac e-Transfer is a convenient way to send and receive money directly from one bank account to another. All you need is access to online or mobile banking, and you can send money to anyone with an email address or mobile phone number and a bank account in Canada — without sharing any personal financial information.

It’s fast

Over 50% of transfer notifications are received instantly, allowing for immediate access to funds once deposited through online banking.

It’s secure

Money is transferred directly between financial institutions, without sharing any personally identifiable financial information. Users are protected with multiple layers of security.

It’s easy

Only a recipient’s email address or mobile number is required to send money. To get started, log in to online banking and follow the instructions to add a recipient and begin sending money.

It’s convenient

Transactions can be conducted anytime, anywhere via online or mobile banking, meaning Canadians have 24/7 access, 365 days a year. Users have access to the service through 255 participating financial institutions.

CRA Direct Deposit

Members can register for the Canada Revenue Agency’s (CRA) direct deposit service, available through WFCU Credit Union and its divisions. This service gives you the ability to simply and securely transmit your direct deposit enrolment information to the CRA when you log onto our online banking platform.

We encourage you to use direct deposit to avoid any delays in receiving your CRA payments.

Business members can receive the following CRA payments through direct deposit:

Pre-Authorized Services

Electronic Pre-Authorized Services allow you to set up pre-authorized debits and credits on your account(s), 24-hours a day, 7 days a week.

Paycheque Direct Deposit and other Regular Payments

Regular paycheques and/or any other payments can be deposited electronically into your account directly from the source. There’s no need to visit a retail location or wait in line to make a deposit. Your funds are deposited into your account on the exact date of payment.

Once your funds are deposited, you can set up automatic transfers at no charge. With automatic transfers, you can conveniently set up a regular savings plan, make regular contributions to your RRSP, and never miss a loan or mortgage payment.

Payroll Deductions

Through an arrangement between your employer and WFCU and its divisions, Payroll Deduction allows you to have a specified amount withdrawn from your paycheque and deposited directly into the account of your choice.

Pre-Authorized Debits

Make arrangements with your bill payment suppliers to automatically debit your account for regular payments. Funds are debited on the date they are due, providing you convenience, as well as time and postage cost savings.