Transforming the traditional ‘chequing account’ by including unlimited transactions with a suite of value-added products.

Get Your FREE* EVA Account!

Fill out the form and one of our member consultants will start the process.

Prefer to skip the form? Contact a branch near you or email info@wfcu.ca.

Unlimited Interac

E-Transfer®

Already Ontario’s best value in banking, we’ve made Eva even better with Unlimited Interac e-Transfer service. An Interac e-Transfer is a simple, convenient, and secure way to send and receive money directly from one bank account to another.

Buyer

Protection

Buyer Protection safeguards purchases made with your Eva account against accidental damage, theft, and even fire for 120 days after purchase. Break your smartphone’s display? You’re covered for item replacement or refund of the full purchase price. That’s convenient coverage you’ll never have to think about.

Extended

Warranty

Extended Warranty doubles the manufacturer’s warranty on items purchased with your Eva account for up to two extra years for many purchases made worldwide. Save money by opting out of expensive, add-on, limited warranty coverage offered by the big box stores, and rest easy knowing you are already covered with Eva!

Price

Protection

Price Protection allows you to shop with confidence and gives you peace of mind at the checkout. Purchases made with your Eva account are eligible for reimbursement towards a lower advertised price, up to 90 days after the purchase.

Eva Chequing Accounts

Choose from a selection of account options with a variety of features and benefits to suit your unique financial needs.

Eva Silver Chequing Account

Eva Silver Chequing Account

- Best for those on a budget

- Unlimited transactions, including deposits, debits, withdrawals, transfers, ATM transactions, and bill payments

The Eva Silver chequing account is the best value in everyday banking with unlimited everyday transactions. This account is free** for members who maintain a $1,000 minimum monthly balance, otherwise a $5.00 monthly fee will apply.

Eva Gold Chequing Account

Eva Gold Chequing Account

All the benefits of Silver, plus:

- Unlimited Interac e-Transfers

- Buyer Protection‡

- Extended Warranty‡

- Price Protection‡

For members who do not maintain a $1,000 minimum balance, the Eva Gold chequing account is offered to members for a monthly fee of $6.50, with no minimum balance required. The Eva Gold chequing account includes benefits that can save members hundreds of dollars per year.

Eva Diamond Chequing Account

Eva Diamond Chequing Account

All the benefits of Silver and Gold, plus:

- Unlimited Certified Cheques

- Unlimited Canadian Drafts

- Unlimited Stop Payments

- Free Cheque Orders, and more!

The Eva Diamond chequing account is offered to members for a monthly fee of $10 with no minimum balance required. Adults 59 years of age and older, and students aged 26-28 can take advantage of the Eva Diamond chequing account for a low monthly fee of $5.

Eva Youth Chequing Account

Eva Youth Chequing Account

- Unlimited Interac e-Transfers

- Opened in youth’s name

- Youth signature only on account card

- Ask about our savings account for youth up to, and including, age 12!

| | Silver | Gold | Diamond | Youth |

|---|---|---|---|---|

| Unlimited Deposits and Transfers | ||||

| Unlimited ATM Withdrawals* | ||||

| Unlimited POS Purchases | ||||

| Unlimited Pre-Authorized Payments | ||||

| Unlimited Mobile and Online Banking | ||||

| Unlimited Interac e-Transfers | ||||

| Buyer Protection ‡ | ||||

| Extended Warranty ‡ | ||||

| Price Protection ‡ | ||||

| Outbound Me-to-Me Transfers | ||||

| USD Drafts | 1/Month | |||

| Canadian Drafts | ||||

| Stop Payments | ||||

| Duplicate and Certified Cheques | ||||

| | FREE** | $6.50 | $10.00

| FREE |

Terms and Conditions

**$5.00 monthly fee waived with $1,000 minimum monthly balance.

‡Terms and conditions apply

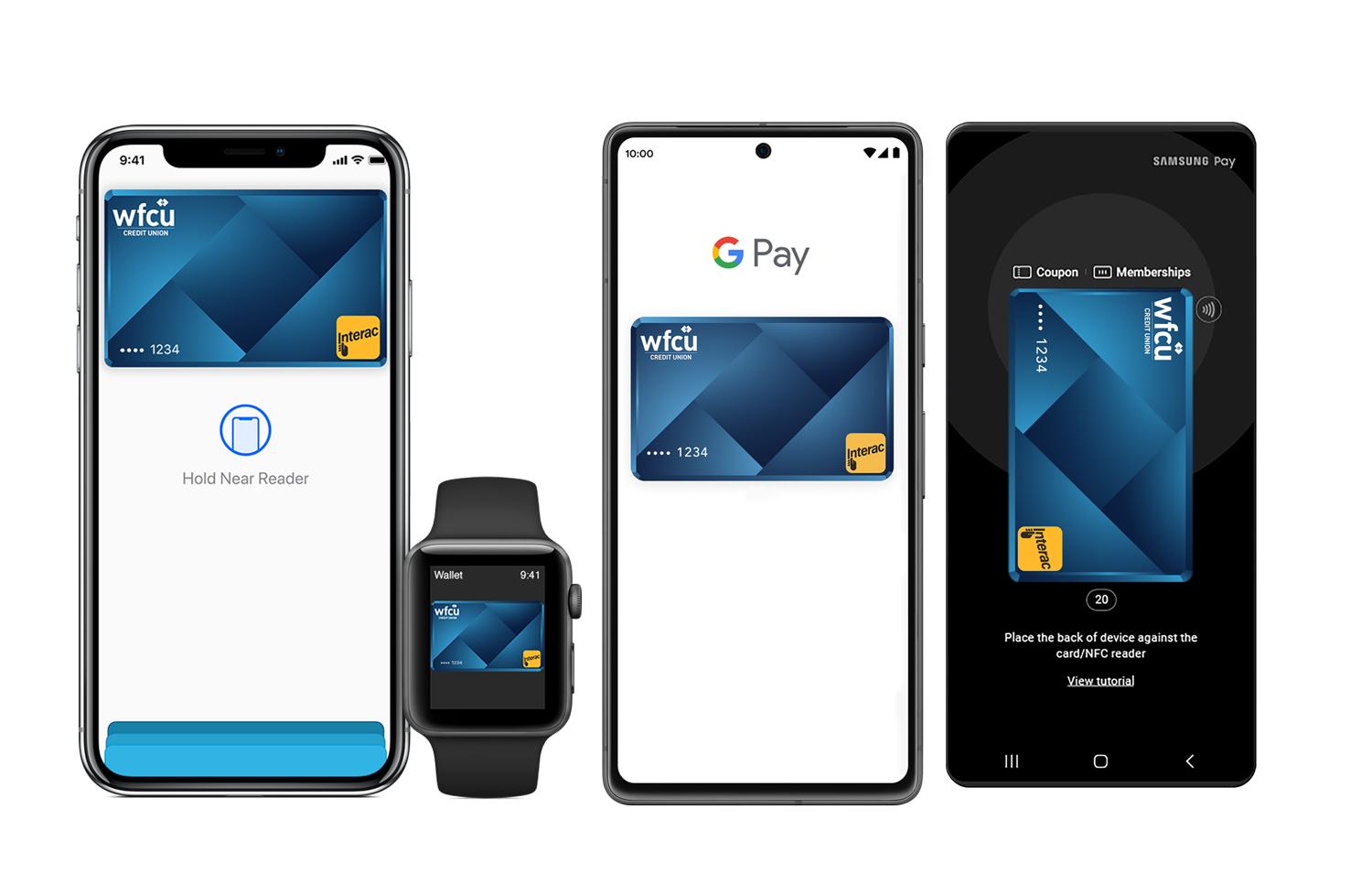

Mobile Wallet

Member cardholders can enjoy the convenience of one-tap payment. Whether you have an iPhone, Samsung, or Google device, load your Visa credit card to your mobile wallet and leave your “physical” wallet at home.

Overdraft Protection for Chequing Accounts

Avoid the cost and inconvenience of having your transaction returned or denied because of insufficient funds with our CU Overdraft Protection service. Whether you’re using an ATM, making an Interac® debit transaction, or have an automatic withdrawal set up, we will automatically cover these transactions, up to your CU Overdraft Protection limit.

There’s no cost for this service until you use it, and when you do, you pay a $4 monthly fee and overdraft interest on the outstanding balance only for the days that you use it. When your account is overdrawn, all deposits to your account are automatically credited to any outstanding overdraft balance.

For ease of record keeping, your CU Overdraft Protection transactions will be included as part of your regular monthly statement with all of your other products and services at WFCU and its divisions.

Debit Mastercard®*

Your Debit Mastercard gives you more freedom, convenience and security – all in one card. This new card is a simple, safe and smart way to access your accounts and money.

Members can continue to use their cards in Canada anywhere Interac is accepted. Additionally, members can now shop online with retailers accepting Debit Mastercard in Canada, and get the added freedom of international acceptance.1 Enjoy the security of Mastercard, the control of debit, and the freedom to shop how you choose, all in one card.

® Mastercard is a registered trademark, and the circles design is a trademark, of Mastercard International Incorporated.

- Debit Mastercard is accepted by international online retailers that accept Mastercard as well as participating online retailers in Canada. View a full list of Canadian online retailers at: www.mastercard.ca/en-ca/personal/find-a-card/debit-cards/debit-accepting-merchants.html

*Terms and Conditions Apply